Televet Pet Care From the Comfort of Home

The Convenience of Televet: Pet Care Reimagined

Gone are the days of frantic dashes to the vet’s office for every sniffle or limp. Televet is revolutionizing pet care, bringing the expertise of veterinary professionals directly into your home. This convenient and often cost-effective approach offers a range of services, from routine check-ups to managing chronic conditions, all from the comfort of your couch.

How Televet Works: A Seamless Virtual Experience

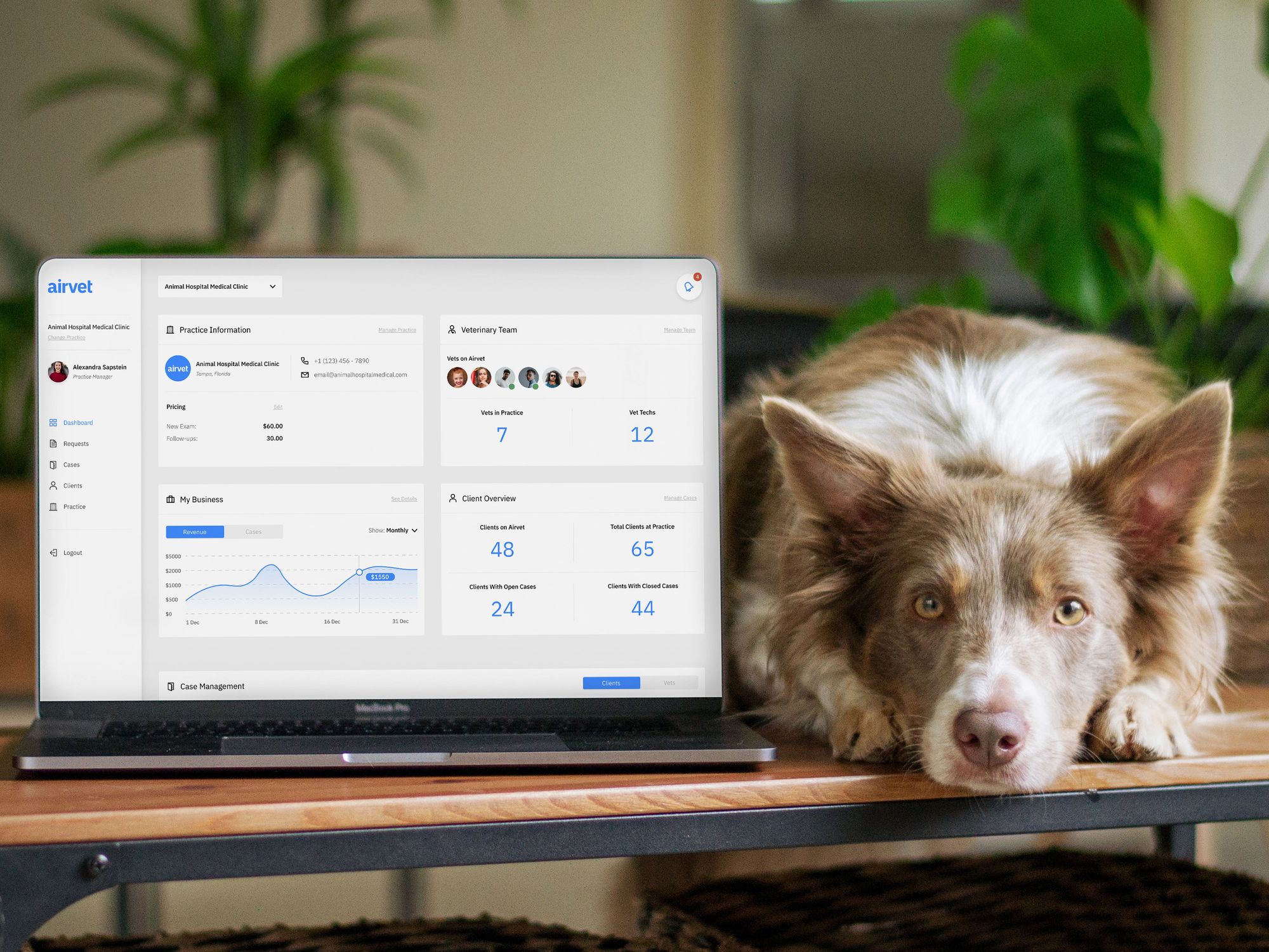

Utilizing video conferencing technology, Televet connects you with licensed veterinarians and veterinary technicians. Before your appointment, you’ll likely be asked to provide some basic information about your pet, including their history, current symptoms, and any relevant photos or videos. During the consultation, the vet will visually assess your pet, ask questions, and offer guidance based on your description and the visual information provided. The entire process is typically very straightforward and user-friendly.

What Conditions are Suitable for Televet?

Televet isn’t a replacement for in-person veterinary care in all situations. However, it’s incredibly useful for a wide range of issues. Routine check-ups for healthy pets, follow-up appointments after surgery or illness, managing chronic conditions like allergies or arthritis, behavioral consultations, and advice on medication administration are all well-suited for Televet. Simple skin issues, minor injuries, and questions about dietary needs can also often be addressed effectively.

When to Seek In-Person Veterinary Care

While Televet offers a wealth of convenience, it’s crucial to understand its limitations. Emergencies, such as severe injuries, difficulty breathing, seizures, or sudden collapses, always require immediate in-person veterinary attention. Similarly, situations requiring physical examination, such as diagnosing complex illnesses or performing procedures, necessitate a visit to a traditional veterinary clinic. Your Televet provider will always be able to advise you on whether an in-person visit is necessary.

The Benefits of Televet: Beyond Convenience

Beyond the obvious convenience, Televet offers several significant advantages. Reduced travel time and costs are major benefits, particularly for pet owners with busy schedules or limited mobility. It can also reduce stress for both pets and owners, as the familiar environment of home can be much less anxiety-inducing than a bustling veterinary clinic. For pets with specific anxieties, the comfort of home can make a huge difference.

Choosing a Reputable Televet Provider: Ensuring Quality Care

As with any healthcare provider, choosing a reputable Televet service is paramount. Look for providers with licensed veterinarians on staff, positive online reviews, and clear descriptions of their services and fees. Check if they offer secure communication channels to protect your pet’s medical information. Don’t hesitate to ask questions about their experience and qualifications before scheduling an appointment. Many services offer free consultations or introductory offers, allowing you to explore their services risk-free.

Televet and Your Pet’s Ongoing Healthcare: A Collaborative Approach

Televet is not a standalone solution but rather a valuable tool in your pet’s ongoing healthcare. It can significantly enhance communication with your regular veterinarian, providing a more comprehensive and collaborative approach to pet care. Regular check-ups through Televet, coupled with occasional in-person visits when necessary, can ensure

:max_bytes(150000):strip_icc()/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png)