VC Investing April 2025’s Hottest Sectors

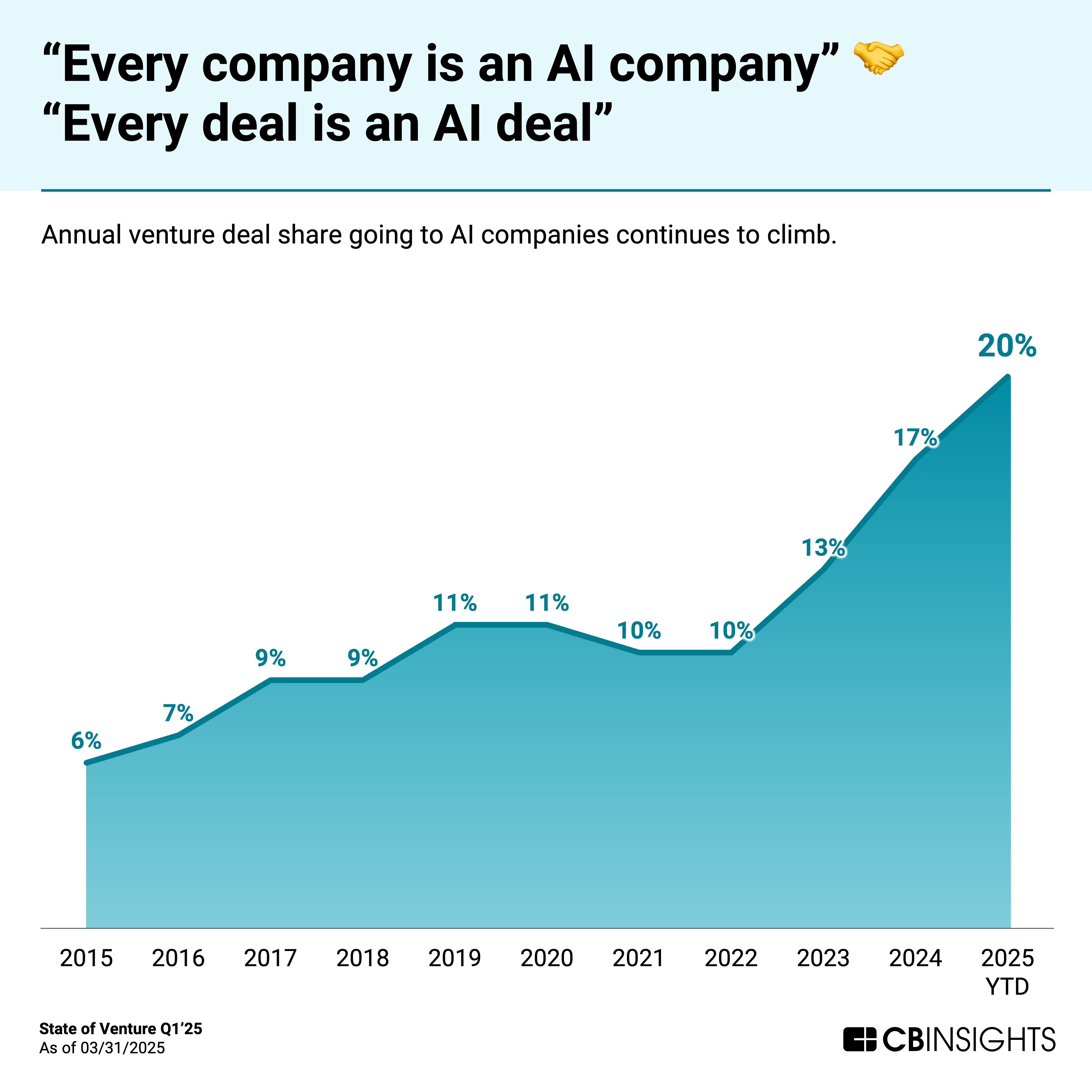

Generative AI: Beyond the Hype

April 2025 sees Generative AI still riding high, but the focus has shifted. Early-stage hype around simple text generation has given way to a more nuanced investment landscape. VCs are now keenly interested in applications of generative AI across diverse sectors – from highly specialized scientific research tools leveraging AI for drug discovery and materials science, to more creative fields like personalized education and architectural design. The key is finding companies that demonstrate real-world utility and strong revenue models, moving beyond the “shiny new toy” phase. Investors are looking for defensible technologies, clear market differentiation, and strong team expertise. Mere novelty isn’t enough anymore; proven traction and scalable business plans are paramount.

Sustainable Technologies: Investing in a Greener Future

The push for environmental sustainability remains a major driver of VC investment. However, “greenwashing” is a significant concern. Investors are becoming increasingly sophisticated in their due diligence, demanding rigorous verification of a company’s environmental impact. This means a sharper focus on solutions with measurable results, particularly in renewable energy (beyond solar and wind, now encompassing innovative energy storage and smart grids), sustainable materials, and carbon capture technologies. Businesses offering genuinely impactful solutions, with transparent metrics and a proven path to profitability, are attracting considerable interest.

The Metaverse Evolves: Beyond Gaming and NFTs

While the initial NFT and metaverse gaming frenzy has cooled, the underlying technologies continue to attract investment. However, the focus has shifted from speculative digital assets to more practical applications. Investors are looking at companies developing immersive technologies for enterprise applications – think advanced training simulations for complex machinery, collaborative design tools for remote teams, or innovative approaches to virtual healthcare. The key is utility and integration into existing workflows, rather than standalone gaming experiences. Companies demonstrating tangible ROI for businesses are securing the most funding.

Cybersecurity: A Constant and Growing Need

Cybersecurity remains a perennial area of significant VC investment. The increasing sophistication of cyber threats and the growing reliance on digital infrastructure necessitate continuous innovation in defensive technologies. Investors are particularly focused on companies addressing emerging vulnerabilities related to AI and the expanding IoT landscape. Solutions focusing on proactive threat detection, AI-driven security, and robust data privacy measures are gaining traction. The need for comprehensive security solutions across diverse sectors ensures continued strong investment in this space.

Personalized Healthcare: Precision Medicine and Beyond

Personalized medicine, driven by advancements in genomics and AI, continues to be a hotbed of VC activity. Investors are interested in companies developing innovative diagnostics, targeted therapies, and personalized treatment plans. The focus is on technologies offering demonstrably improved patient outcomes and cost-effectiveness. Furthermore, digital health solutions enabling remote patient monitoring, telehealth platforms, and AI-powered diagnostic tools are also attracting substantial investment. The emphasis is on scalable solutions that can improve access to quality healthcare.

Space Tech: The Final Frontier for Investment

The burgeoning space industry is experiencing a significant influx of VC capital. While satellite technology remains a key area, investment is broadening to encompass other aspects of