Understanding the Basics of Interest Rates

Interest rates are essentially the cost of borrowing money. When you take out a loan, whether it’s for a mortgage, a car, or a credit card, you pay interest on the amount you borrow. This interest is a percentage of the principal (the original loan amount) and is calculated over a specific period. Similarly, when you save money in an interest-bearing account, the bank pays you interest as a reward for lending them your money. These rates are influenced by various economic factors, including inflation, government policy, and overall economic growth.

How Interest Rate Hikes Affect Borrowers

When interest rates rise, borrowing money becomes more expensive. This means that the monthly payments on loans will increase. For example, if you’re considering buying a house and interest rates jump, your mortgage payments will be significantly higher, potentially making the house unaffordable. Existing borrowers with variable-rate loans (like some mortgages and credit cards) will feel the impact immediately, as their monthly payments adjust with the changing interest rate. Those with fixed-rate loans will be unaffected until their loan term ends and they refinance.

The Impact on Savers

While rising interest rates are bad news for borrowers, they can be good news for savers. Higher interest rates mean that savings accounts, certificates of deposit (CDs), and other interest-bearing accounts will earn a higher return. This allows your savings to grow faster, potentially offsetting some of the increased costs of borrowing.

The Influence on Investment Strategies

Rising interest rates often impact investment strategies. Bonds, which are considered less risky than stocks, become more attractive when interest rates rise, as they offer higher yields. Conversely, rising rates can sometimes negatively affect the stock market, as higher borrowing costs can slow down business growth and reduce company profits. This makes it crucial to carefully review and potentially adjust your investment portfolio to navigate the changing economic landscape.

Navigating Rising Interest Rates: Practical Tips for Consumers

Facing rising interest rates requires proactive financial planning. Review your budget to identify areas where you can cut back on spending. Consider consolidating high-interest debt to lower your overall monthly payments. If you’re planning a significant purchase like a car or a house, carefully assess the impact of higher interest rates on your affordability. Explore different loan options and compare interest rates before committing to a loan. Don’t hesitate to speak with a financial advisor who can provide personalized guidance on how to manage your finances during this period.

The Ripple Effect on the Economy

Interest rate hikes are often implemented by central banks as a tool to control inflation. By making borrowing more expensive, they aim to slow down economic growth and reduce demand, thereby curbing inflation. However, this can have a ripple effect across the economy. Businesses might postpone investments due to higher borrowing costs, which can lead to slower job growth. Consumers may reduce spending, further dampening economic activity. It’s a delicate balancing act for central banks, aiming to control inflation without triggering a recession.

Long-Term Implications and Future Outlook

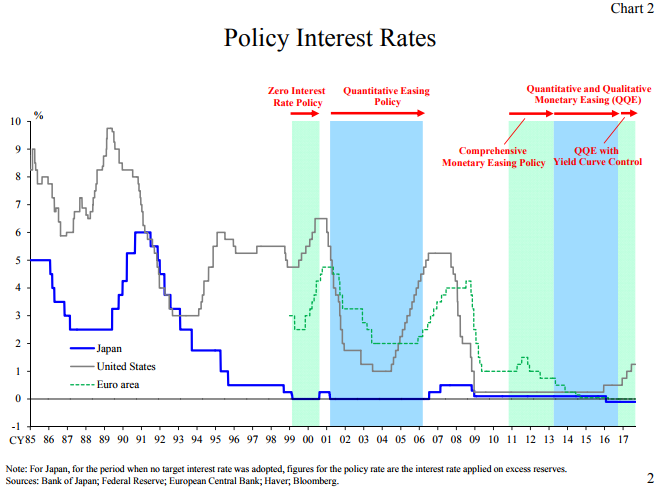

The long-term implications of rising interest rates depend on various factors, including the magnitude and duration of the rate increases and the overall health of the economy. It’s crucial to stay informed about economic news and trends, paying close attention to announcements from central banks and government agencies. Understanding the potential impact on your personal finances allows you to make informed decisions and adapt your financial strategies accordingly. While uncertainty exists, proactive planning and informed decision-making can help navigate the challenges and opportunities presented by fluctuating interest rates. Please click here to learn about interest rate policy.