Introduction:

In the ever-evolving landscape of the United States, opportunities for financial growth abound. This article explores the diverse avenues and strategies available for individuals seeking to navigate and capitalize on the financial opportunities present in the USA.

Investing in the Stock Market:

One of the primary avenues for financial growth is the stock market. Investing in well-researched stocks or diversified funds can yield substantial returns over time. Understanding market trends, risk tolerance, and long-term financial goals are crucial components of a successful investment strategy.

Real Estate Ventures:

Real estate remains a cornerstone of wealth creation. Whether through property ownership, rental income, or real estate investment trusts (REITs), the real estate market offers a range of opportunities for individuals looking to build and diversify their financial portfolios.

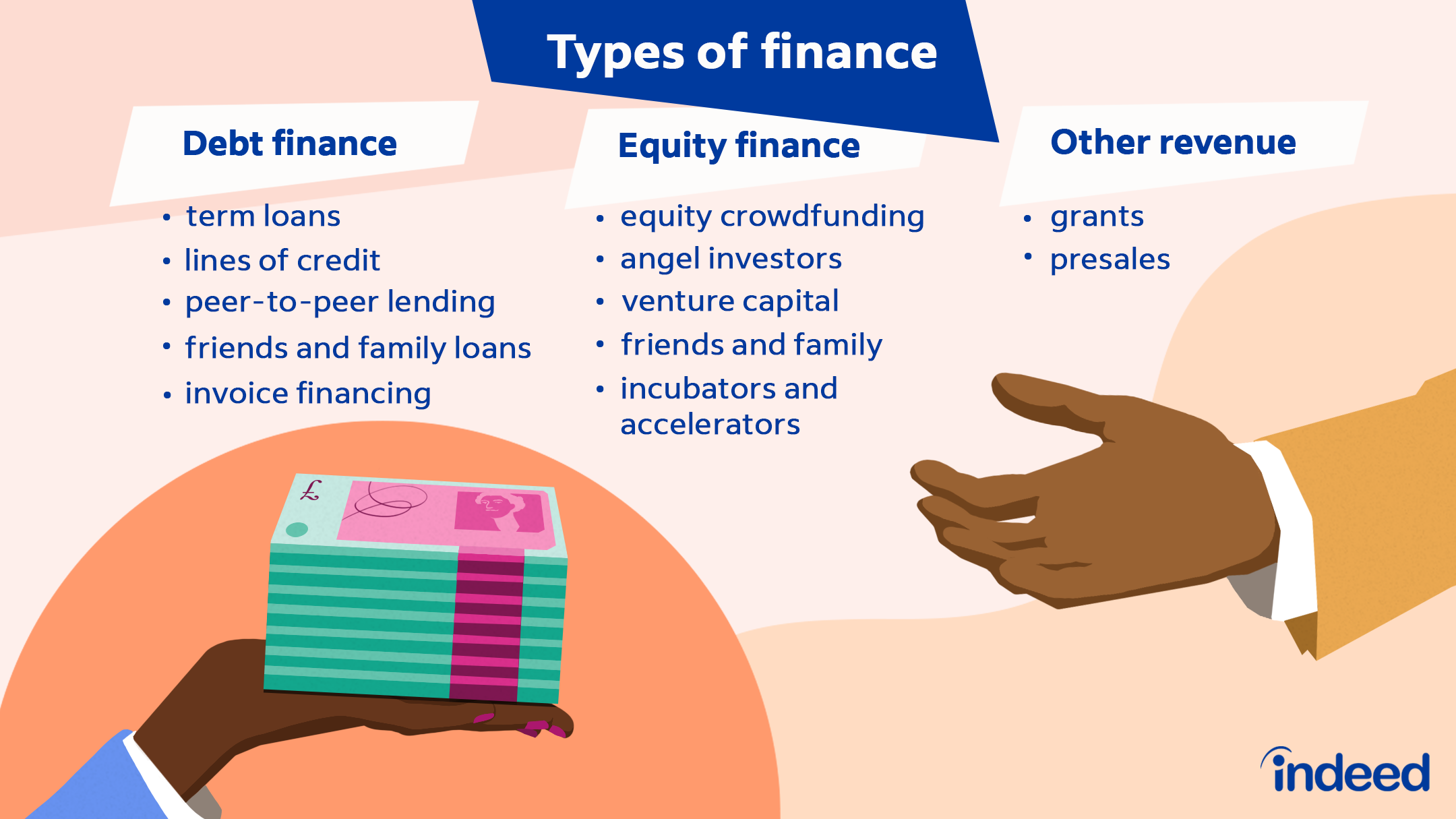

Entrepreneurship and Small Business Ventures:

The entrepreneurial spirit is alive and well in the USA. Starting a small business or investing in a promising venture can be a pathway to financial success. Government support, access to capital, and a dynamic market make the USA fertile ground for those with innovative business ideas.

Educational and Career Advancements:

Investing in education and career development is a strategic move toward financial prosperity. Continuous learning and skill-building not only enhance employability but also open doors to higher-paying opportunities and career advancement in a competitive job market.

Cryptocurrency and Emerging Technologies:

The rise of cryptocurrency and blockchain technologies has created new financial opportunities. While volatile, cryptocurrencies offer the potential for significant returns. Staying informed about emerging technologies can uncover innovative investment prospects in the ever-changing tech landscape.

Retirement Planning and Investment Accounts:

Planning for the future is a fundamental aspect of financial success. Contributing to retirement accounts like 401(k)s or IRAs not only provides tax advantages but also ensures a secure financial future. Understanding investment options within retirement plans is key to optimizing long-term financial well-being.

Government Programs and Grants:

The U.S. government offers various programs and grants to support individuals in pursuit of financial stability. From homeownership assistance to educational grants, exploring these opportunities can provide a valuable financial boost.

Financial Literacy and Advisory Services:

Knowledge is power in the realm of finance. Enhancing financial literacy through courses, workshops, and advisory services empowers individuals to make informed decisions about investments, savings, and overall financial planning.

Side Hustles and Gig Economy Opportunities:

In the age of gig economies, side hustles present additional streams of income. Platforms offering freelance work, part-time gigs, or the opportunity to monetize skills can supplement traditional income and contribute to financial resilience.

Community and Networking:

Engaging with communities and networks focused on financial empowerment can provide insights, mentorship, and collaboration opportunities. Networking within these circles can uncover hidden opportunities and create a supportive environment for financial growth.

In the pursuit of financial opportunities, individuals can explore a multitude of paths. Visit Financial Opportunities in USA for a comprehensive resource hub offering valuable insights, tools, and strategies to navigate and capitalize on the diverse financial opportunities available in the United States.